A National Micro, Small, and Medium Enterprises (MSME) Cluster Outreach Programme took place at the DC Conference Hall in Dimapur on November 9, 2024 to promote MSME development and financial support in Nagaland. Organized by the State Level Bankers Committee (SLBC) Nagaland, the event brought together key banking sector representatives and local MSME leaders to discuss financial resources and loan requirements for MSMEs.

The program was chaired by SLBC Coordinator H. Lalhimpuia, who welcomed participants and initiated discussions with banking officials and Dimapur cluster representatives. Dhruba Charan Pal, General Manager, Network Work-II of SBI Guwahati; Bhanu Prakash Verma, General Manager and Regional In-charge of SIDBI Guwahati; and Surabhi Bhattacharyya, Deputy General Manager, SBI Jorhat, offered insights on accessing MSME financial services. Aolemba Longkumer, Chairman of the Wooden Furniture Cluster in Dimapur, shared specific challenges and needs within Dimapur’s furniture sector, such as access to advanced machinery and improved marketing resources.

Banking representatives outlined essential criteria for MSMEs to qualify for bank loans, emphasizing the importance of:

A Good CIBIL Score: Banks evaluate the creditworthiness of MSMEs based on their CIBIL score, which reflects their financial discipline and repayment history.

Organized Financial Documentation: MSMEs must maintain a balance sheet, updated financial records, and other documents to verify their financial health.

Transaction Through Bank Accounts: Ensuring that all business transactions are routed through a bank account is critical for establishing a transparent financial history.

Adequate Collateral and Business Plan: Presenting viable business plans and collateral, if required, strengthens loan applications.

The session covered 12 government initiatives supporting MSMEs, including access to credit, market expansion, technology upgrades, and ease of doing business. The PM Vishwakarma scheme, targeting artisans and craftspeople, was highlighted for integrating traditional skills into national and international markets. Dimapur’s MSME cluster, with 90 active members, identified improved technology and equipment as crucial for connecting with larger industries and increasing competitiveness.

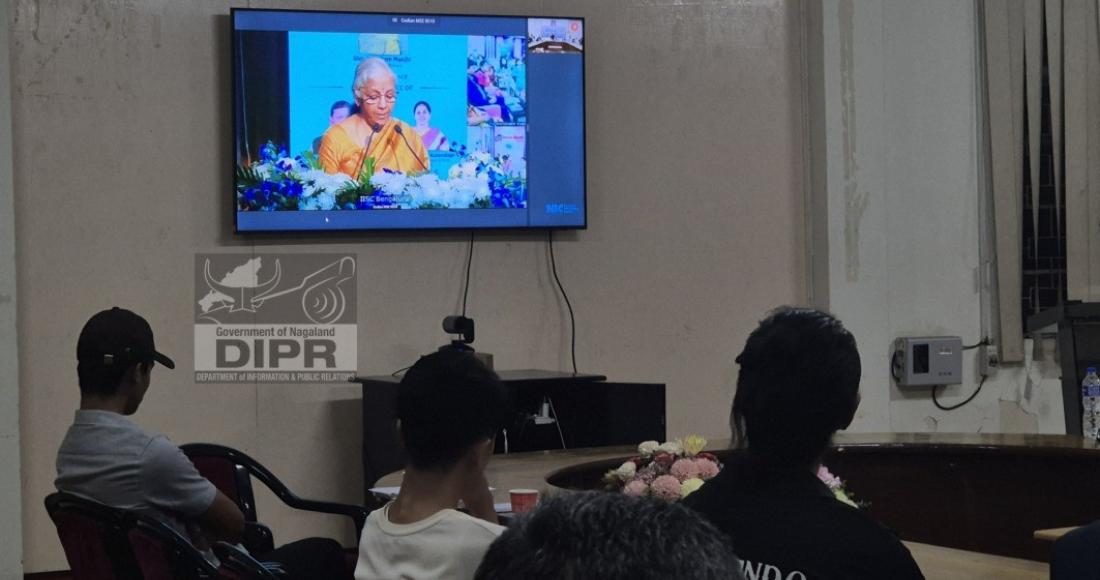

Following the Dimapur outreach program, the Dimapur Cluster members and Representatives from SBI bank joined the Finance Minister, Nirmala Sitharaman at the Peenya Cluster in Bengaluru, Karnataka virtually. Sitharaman virtually inaugurated six new Small Industries Development Bank of India, (SIDBI) branches, five Nari Shakti Branches of Union Bank of India, and a new Learning Centre for Canara Bank. Sitharaman addressed MSME representatives nationwide, emphasizing the government’s ongoing commitment to expanding MSME opportunities.

Sushri Sobha Karandlaje, Minister of State for MSME; Pankaj Chaudhary, Minister of State for Finance; and Jitan Ram Manjhi, Minister of MSME addressed the gathering, emphasizing the government’s dedication to strengthening MSMEs nationwide.

An MoU was signed with the Peenya Industries Association, and sanction letters were distributed to SIDBI borrowers from newly inaugurated branches across Karnataka during the event.